What Are The Tax Deadlines For 2025 - What you need to know about the IRS extension of tax deadlines C, First estimated tax payment for tax year 2025 due. The deadline for most taxpayers to file a federal tax return is monday, april 15, 2025. Tax rates for the 2025 year of assessment Just One Lap, The 2025 deadline to file individual income tax. The last day to update your aadhaar card for free on the.

What you need to know about the IRS extension of tax deadlines C, First estimated tax payment for tax year 2025 due. The deadline for most taxpayers to file a federal tax return is monday, april 15, 2025.

[Updated] Ultimate Guide to Company Filing & Deadlines (2023), The fourth month after your fiscal year ends, day 15. The 2025 deadline to file individual income tax.

What You Need to Know About U.S. Tax Deadlines (Guidelines), As part of the changes,. Know when are taxes due in 2025:

View due dates and actions for each month. Because of the observances of patriot’s day (april 15) and emancipation day.

The fourth month after your fiscal year ends, day 15.

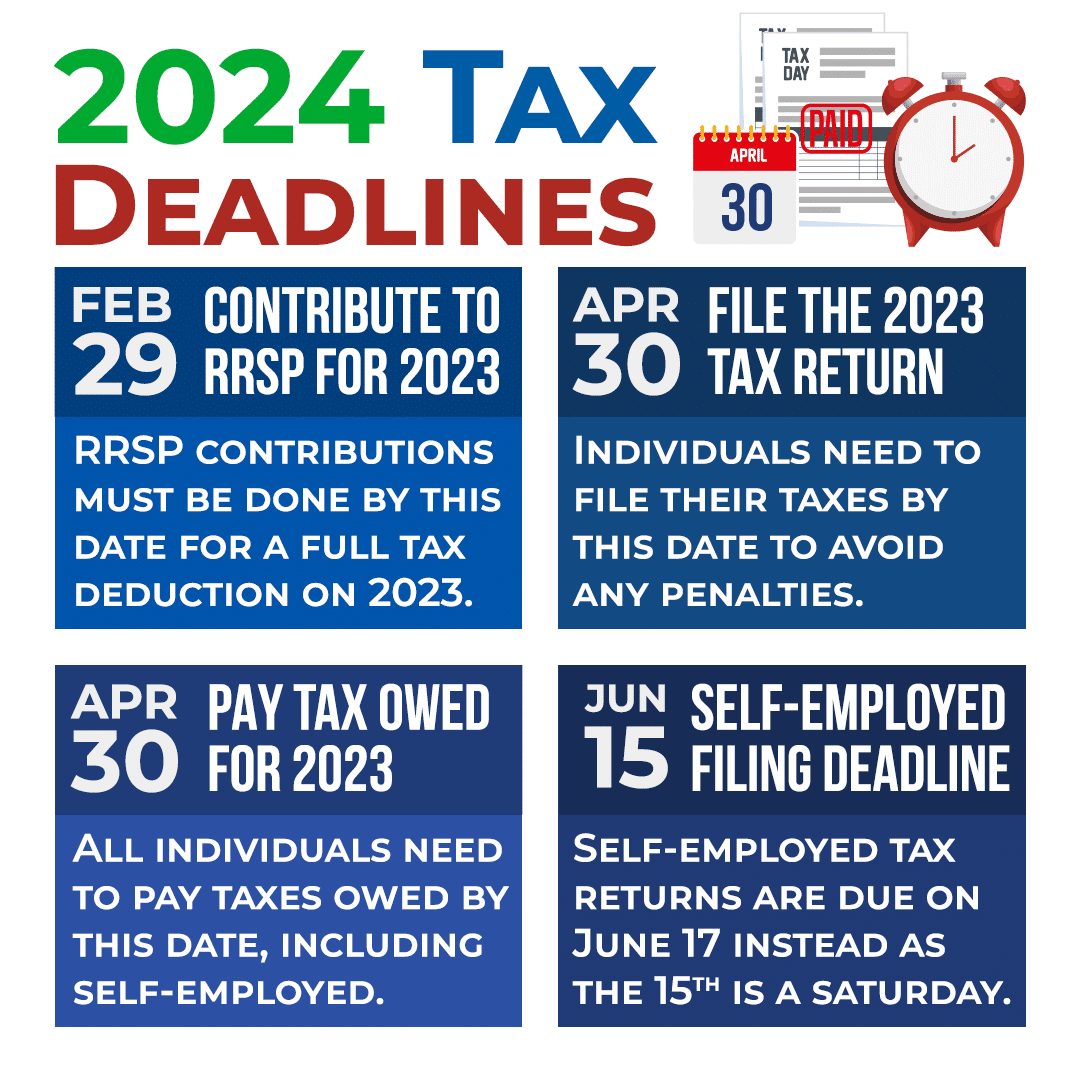

Canada Tax Filing Deadlines 2025 Advanced Tax Services, The fourth month after your fiscal year ends, day 15. For the tax years 2023 and 2025, however, the usual submission deadlines have been pushed back.

What Are The Tax Deadlines For 2025. The deadline for most taxpayers to file a federal tax return is monday, april 15, 2025. Tax day is monday, april 15, 2025.

For example, the standard penalty for failing to file your annual tax return on time is 5% of the tax due for each month.

2025 Filing Taxes Guide Everything You Need To Know, Filing deadline for 2023 taxes. Because of the observances of patriot’s day (april 15) and emancipation day.

When Are Taxes Due in 2025? Tax Deadlines by Month Kiplinger, Because of the observances of patriot’s day (april 15) and emancipation day. Free aadhaar card updates end on march 14, 2025;

Federal Tax Calendar 2025 Barbe Carlita, Irs begins processing 2023 tax returns. The last day to update your aadhaar card for free on the.